IRS Form 886-H-EIC 2022-2026 free printable template

Show details

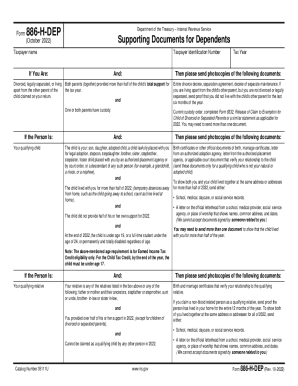

886HEICForm (October 2022)Department of the Treasury Internal Revenue ServiceDocuments You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children for Tax Year

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign form 886

Edit your form 886 h eic form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 886 h eic form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs form 886 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 886 h dep. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Form 886-H-EIC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 886 h aoc

How to fill out IRS Form 886-H-EIC

01

Obtain IRS Form 886-H-EIC from the IRS website or a local IRS office.

02

Review the requirements to ensure you meet the criteria for the Earned Income Tax Credit (EITC).

03

Gather necessary documents such as proof of income, child dependents' Social Security numbers, and any other relevant financial records.

04

Complete the top section of the form with your personal information, including your name, address, and taxpayer identification number.

05

Fill out Part I of the form by providing details about your qualifying children, including their names, birth dates, and Social Security numbers.

06

Complete Part II of the form by reporting your income sources and amounts for the tax year.

07

Review and ensure that all information is accurate and matches your tax return.

08

Sign and date the form before submission.

09

Submit the form along with your tax return or as instructed by the IRS.

Who needs IRS Form 886-H-EIC?

01

Individuals who are claiming the Earned Income Tax Credit (EITC) and need to verify their eligibility based on their qualifying children and income.

02

Taxpayers with children who want to take advantage of the EITC and may require additional documentation to substantiate their claim.

Fill

886 h eic 2024

: Try Risk Free

People Also Ask about 886 h aoc

What are disallowed credits?

If the IRS determined a taxpayer claimed the credit(s) due to reckless or intentional disregard of the rules (not due to math or clerical errors) the taxpayer can't claim the credit(s) for 2 tax years. If the error was due to fraud, then the taxpayer can't claim the credit(s) for 10 tax years.

Who qualifies for the expanded earned income tax credit?

Basic Qualifying Rules To qualify for the EITC, you must: Have worked and earned income under $59,187. Have investment income below $10,300 in the tax year 2022.

What does claim disallowed mean?

The “Claim Disallowance” IRS Letter 105C or Letter 106C is your legal notice that the IRS is not allowing the credit or refund you claimed.

How do I know if my EIC was disallowed?

If you are unsure if you have been previously disallowed for EIC, you would need to contact the IRS at 1-800-829-1040 to find out.

What is the EIC credit for 2018?

The maximum credits were $519 with no qualifying children, $3,461 with one qualifying child, $5,716 with two qualifying children, or $6,431 with three or more qualifying children. Since 1975 many states have supplemented the federal EITC program by adopting their own versions of the federal program.

What is the IRS Form 886 H EIC?

More In Form 886-H-EIC Toolkit This tool is to help you identify what documents you need to provide to the IRS, if you are audited, to prove you can claim the Earned Income Tax Credit (EITC) with a qualifying child (if you are not sure you are qualified, use the EITC Assistant to find out if you qualify).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify eic form without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including form 886 irs. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find 886 h dep?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the taxpayers who claim the earned search in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I edit who needs 886 h eic eic to substantiate their claim on an Android device?

You can make any changes to PDF files, such as eic template, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is IRS Form 886-H-EIC?

IRS Form 886-H-EIC is a document used by taxpayers to verify their eligibility for the Earned Income Tax Credit (EITC) by providing required information about their qualifying children.

Who is required to file IRS Form 886-H-EIC?

Taxpayers who claim the Earned Income Tax Credit and have qualifying children must file IRS Form 886-H-EIC to substantiate their claims.

How to fill out IRS Form 886-H-EIC?

To fill out IRS Form 886-H-EIC, taxpayers must provide their personal information, details about their qualifying children, and the documentation that proves their eligibility for the EITC.

What is the purpose of IRS Form 886-H-EIC?

The purpose of IRS Form 886-H-EIC is to help taxpayers provide necessary documentation to the IRS to prove their entitlement to the Earned Income Tax Credit.

What information must be reported on IRS Form 886-H-EIC?

On IRS Form 886-H-EIC, taxpayers must report their name, Social Security number, information about each qualifying child, and details about their relationship to the child and residency.

Fill out your IRS Form 886-H-EIC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxpayers Who Claim The Earned To The Child And Residency is not the form you're looking for?Search for another form here.

Keywords relevant to obtain the fillable 886 h eic form from the irs income tax credit eitc to ensure you qualify

Related to eic form 2024

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.