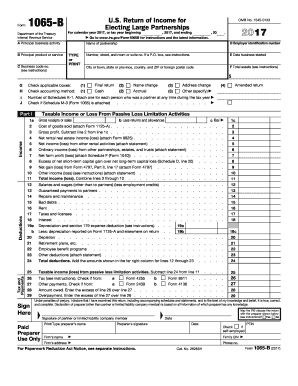

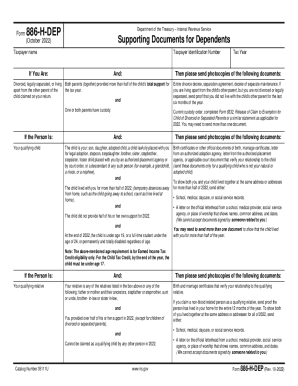

IRS Form 886-H-EIC 2022-2024 free printable template

Get, Create, Make and Sign

Editing 886 h eic online

IRS Form 886-H-EIC Form Versions

How to fill out 886 h eic 2022-2024

To fill out the H EIC income, follow these steps:

Video instructions and help with filling out and completing 886 h eic

Instructions and Help about h eic form

All right so welcome to the podcast I'm your host George Castellano jr aka mobile tax she says I have a guest here hello Teresa Buddhist yoga that's me hotel cells extraordinaire all-around good person now I'm falling I'm still working its past tax season right, so tax season has been long gone but right I mean if you filed an extension it would get the file for that extent I know right well in this case my aunt came it came to me the last second last day of tax season right she wants me to do her taxes father taxes all the information she gave me and apparently yeah it got rejected, so we need a file a form 8862 and for whatever for all of you out there that don't know what a form 8862 is well its it's, and it's a form that you file for a claim or credit that you claimed one year, but then they took it away, or they disallowed it right well they would for example they would take it away because he didn't it was an alleged claim it was a like say for example maybe you claimed a child that was not yours or somebody and somebody else claimed him and be like hey I got to prove that justice kid was with me more than half of the year here's my proof oh then we have to take the money away from this person, so this is these are the situations that were dealing with I don't know what's going on I don't know really what happened I reached out to my aunt via text message right she's she's an elderly lady she's like maybe no she has a young spirit about her, I love my did, but she may be in her lady with no early sixties live yeah late 50 well maybe well yeah yeah I guess that's not too far from a gap right so me trying to communicate to her through text message and screenshots and emails it's quite a challenging yes that's the way quite challenging, so anyway I send her a text and I told her well what appears to have happened is that you claim the credit that you should have gotten I was trying to break it down and simple simplest terms right and I so but there's a form that we can fill out that will see if we can get you that credit, and she said okay she said okay she didn't deny it she was like she didn't she wasn't like oh no no I didn't dare yeah yeah yeah she kind of she knew and that we are I mean I knew when I was founder taxes I had that feeling, and I was like wow man, but I didn't do my due diligence but regardless of the fact I want to try to get her maximum refund, so this form is available for these type of situations, so I got the form put up right here in the iron right go to the forms section, and you just put in the number of form that you're trying to find in this case I'm looking for form 8862 it says information to claim certain credits after this allowance all right this is general instructions future developments what's new reminders right well the purpose of this forum right you must complete form 8862 and attach it to your tax return to claim an Earned Income Credit, so that's that's uh-oh there are others like CTC might be a...

Fill irs 886 h eic : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 886 h eic 2022-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.